Generative AI will Forever Change the Mobile Dashboard in Financial Apps

May 12, 2023 | By Bill Mak

As Artificial Intelligence (AI) continues advancing and becoming increasingly accessible to mobile apps, an increasing variety of financial institutions are turning to AI to support their customers. As AI continues to evolve, it is certain that the possibilities for how generative AI is used in banking apps will expand. AI will allow banks to offer better, more tailored services to customers, while at the same time, increase the safety and security of online banking. This discussion focuses on ways generative AI interactions have the potential to evolve mobile dashboards in financial apps, providing a more intuitive and personalized experience.

How Generative AI improves app interactions

By substituting the need for a human-to-human interaction, Generative AI which uses advanced deep learning algorithms to create unique content from scratch. It can produce original personalized content in every type of app. Generative AI can also be used to enable new forms of user engagement by responding to requests with really useful and interesting personalized “stories” that are contextually aware, i.e., deeply tailored to help users better understand and interact with their information.

What Generative AI can do for Mobile Dashboard UX

Generative AI is already making its presence known in the financial industry. For instance, AI-powered bots have been used to provide customer service in banking chat applications, helping customers quickly and effectively with their needs and inquiries. Additionally, AI is being used to create personalized and tailored services and experiences for customers, allowing them to access a wide range of services efficiently and with greater ease. AI-Mediated data visualization tools are helping customers understand their spending for example, allowing them to make wiser decisions when it comes to managing their finances.

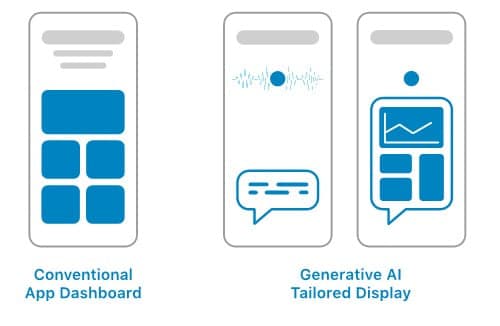

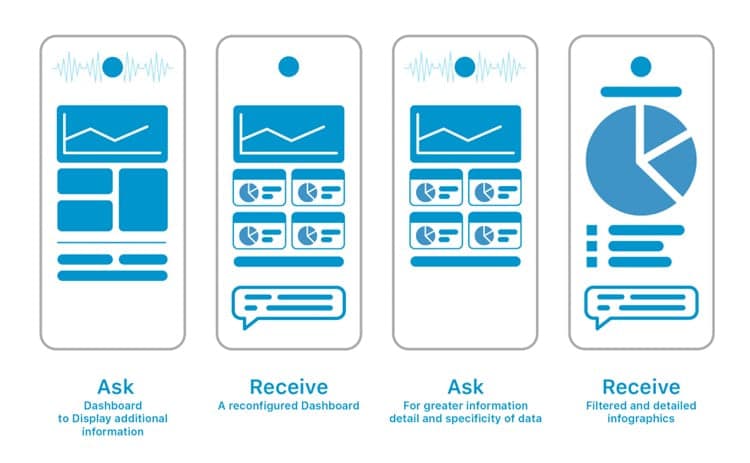

The above illustration is one example where generative AI is set to dramatically transform the financial services app dashboard by using data from customer interactions to build intelligent models that can accurately predict customer behaviors and suggest tailored information displays. Currently, financial services app dashboards are populated largely with fixed interactive widgets that only have limited customization, with generative AI, dashboards will become contextually aware, interactive, and engaging, dashboard widgets are generated and configured on-demand based on the verbal interaction with a financial services AI. The dashboard can easily be re-generated and re-configured with simple conversations, i.e. conversational interactions that deliver greater sense of mutual delight as proposed below.

AI-powered information display can be seamlessly updated using natural conversations and display data in a more comprehensive, interactive manner. This could be used to allow customers to visualize their wealth ways that were never possible before. Furthermore, these visualizations could be tailored to the individual customer so that the data is always presented in the most relevant way without having to perform multiple taps on the screen to navigate or refine the display.

Finally, generative AI can be used to create engaging and interactive experiences for customers in banking app dashboards. It is possible to use AI to generate story-based information display, allowing customers to better understand their data in a more engaging manner. It is also possible to use AI to generate personalized content and experiences and provide a wealth of possibilities that weren't feasible before and are revolutionizing the way financial institutions interact with their customers.

Need help with custom app development in Vancouver? Then contact us today.

Contact Us

Let’s chat!

Find out how we can work together to bring your ideas to life.

Copyright © 2025 Atimi Software Inc. | All Rights Reserved | Sitemap | Privacy Policy